Recording transactions in T accounts; trial balance

On May 15, George Manny began a new business, called Sounds, Inc., a recording studio to be rented out to artists on an hourly or daily basis. The following six transactions were completed by the business during May:

(A.) Issued to Manny 5,000 shares of capital stock in exchange for his investment of $200,000 cash.

(B.) Purchased land and a building for $410,000, paying $100,000 cash and signing a note payable for the balance. The land was considered to be worth $310,000 and the building $100,000.

(C.) Installed special insulation and soundproofing throughout most of the building at a cost of $120,000. Paid $32,000 cash and agreed to pay the balance in 60 days. Manny considers these items to be additional costs of the building.

(D.) Purchased office furnishings costing $18,000 and recording equipment costing $88,400 from Music Supplies. Sounds paid $28,000 cash with the balance due in 30 days.

(E.) Borrowed $180,000 from a bank by signing a note payable.

(F.) Paid the full amount of the liability to Music Supplies arising from the purchases in D above.

Instructions

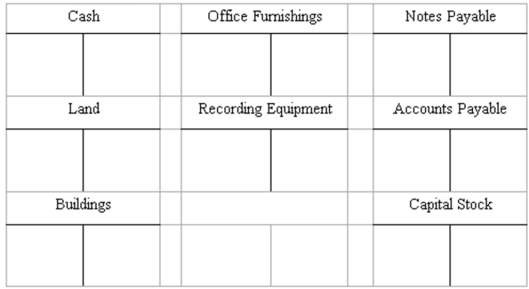

(A.) Record the above transactions directly in the T accounts below. Identify each entry in a T account with the letter shown for the transaction. This exercise does not call for the use of a journal.

(B.) Prepare a trial balance at May 31 by completing the form provided.

SOUNDS, INC.

Trial Balance

May 31, 20__

Debit Credit

Definitions:

Informational Report

An informational report is a factual document intended to inform its audience about specific subjects without persuading or providing recommendations.

Directive

An authoritative command or instruction that guides or directs action, commonly used in organizational, legal, or programming contexts.

New Policy

A recently introduced guideline or set of rules designed to direct decisions and actions within an organization.

Appendixes

Supplementary materials or sections at the end of a document providing additional information.

Q8: Closing entries<br>An Adjusted Trial Balance for Tiger,

Q8: A and B are partners. A has

Q13: Effects of transactions on balance sheet items<br>Show

Q16: An inexperienced accounting intern at Tasso Company

Q18: Anthony Driver wants to buy a new

Q22: Which of the following journal entries is

Q93: Adjusting entries<br>Selected ledger accounts used by

Q97: Although accounting information is used by a

Q124: Which of the following would you expect

Q139: The left-hand side of an account is