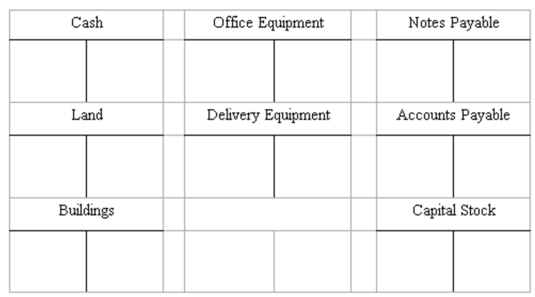

Recording transactions directly in T accounts; trial balance

On July 20, Mollie Rose began a new business called MR Printing, which provides typing, duplicating, and printing services. The following six transactions were completed by the business during July.

(A.) Issued to Rose 1,000 shares of capital stock in exchange for her investment of $200,000 cash.

(B.) Purchased land and a small building for $450,000, paying $165,000 cash and signing a note payable for the balance. The land was considered to be worth $240,000 and the building $210,000.

(C.) Purchased office equipment for $30,000 from Quality Interiors, Inc. Paid $17,000 cash and agreed to pay the balance within 60 days.

(D.) Purchased a motorcycle on credit for $3,400 to be used for making deliveries to customers. Mollie agreed to make payment to Spokes, Inc. within 10 days.

(E.) Paid in full the account payable to Spokes, Inc.

(F.) Borrowed $30,000 from a bank and signed a note payable due in six months.

Instructions

(A.) Record the above transactions directly in the T accounts below. Identify each entry in a T account with the letter shown for the transaction. This exercise does not call for the use of a journal.

(B.) Prepare a trial balance at July 31 by completing the form provided.

Definitions:

Feature-Length Film

A movie that is long enough to be considered the main or sole film to fill a program, typically over 60 minutes in length.

First Amendment

Part of the United States Constitution that protects freedom of speech, religion, press, assembly, and the right to petition the government.

Bill of Rights

The first ten amendments to the United States Constitution, guaranteeing fundamental civil rights and liberties such as freedom of speech, religion, and press.

Mutual Decision

A choice or resolution made jointly by two or more parties where all involved agree on the outcome or course of action.

Q1: The book value of an asset may

Q8: Sam Rivers has $3,000 to invest. He

Q21: Financial accounting standards issued by the FASB

Q39: The credit side of an account is

Q42: During the month of May, the Henderson

Q63: The manager of Grande Home Improvements purchased

Q66: Generally accepted accounting principles:<br>A) Are based on

Q87: The adjusting entry to record income taxes

Q96: An accounting principle must receive substantial authoritative

Q122: The IRS tax return is one of