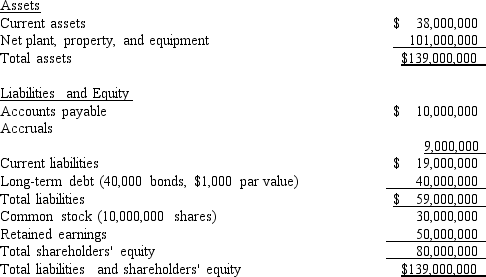

Exhibit 9.1

The Collins Group, a leading producer of custom automobile accessories, has hired you to estimate the firm's weighted average cost of capital.The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable $1, 000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00.The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%.The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years.The firm's tax rate is 40%.

-Refer to Exhibit 9.1.What is the best estimate of the after-tax cost of debt?

Definitions:

Actual Reserves

The total amount of funds that a bank has in its vault or deposited with the central bank, available to meet withdrawal demands or regulatory requirements.

Federal Reserve Banks

The regional banks of the Federal Reserve System, the central bank of the United States, which regulate and serve banks, execute monetary policy, and provide financial services.

Privately Owned

Businesses or properties owned by individuals or corporations rather than by the government or public entities.

Publicly Controlled

Operations or organizations that are owned, operated, or regulated by the government or public authorities.

Q12: Which of the following statements is correct?<br>A)

Q33: Which of the following should not influence

Q38: Silverman Co.is considering Projects S and L,

Q44: Bonds for two companies were just issued:

Q54: Preferred stock is a hybrid¾a sort of

Q88: A lockbox plan is<br>A) used to identify

Q94: DHF Company has a beta of 1.5

Q101: In theory, capital budgeting decisions should depend

Q118: Suppose that during the coming year, the

Q124: A firm's peak borrowing needs will probably