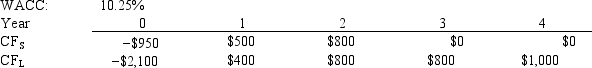

Farmer Co.is considering Projects S and L, whose cash flows are shown below.These projects are mutually exclusive, equally risky, and not repeatable.If the decision is made by choosing the project with the shorter payback, some value may be forgone.How much value will be lost in this instance? Note that under some conditions choosing projects on the basis of the shorter payback will not cause value to be lost.

Definitions:

Absorption Costing

An accounting method that includes all manufacturing costs in the cost of a product, including fixed and variable costs.

Variable Costing

A costing method that includes only variable production costs (materials, labor, and overhead) in product costs.

Net Operating Income

This represents the total profit of a company after subtracting operating expenses, excluding taxes and interest.

Variable Costing

An accounting method that considers only variable costs as product costs, with fixed costs treated as period costs.

Q1: According to the basic DCF stock valuation

Q14: The term "additional funds needed (AFN)" is

Q25: Howes Inc.purchases $4, 562, 500 in goods

Q27: Estimating project cash flows is generally the

Q40: We can identify the cash costs and

Q50: Daylight Solutions is considering a recapitalization that

Q54: The CAPM is built on historic conditions,

Q60: Which of the following statements is CORRECT?

Q69: Stock X has the following data.Assuming the

Q130: Because money has time value, a cash