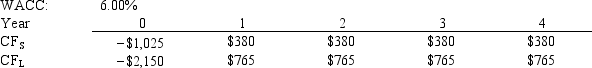

Murray Inc.is considering Projects S and L, whose cash flows are shown below.These projects are mutually exclusive, equally risky, and not repeatable.The CEO wants to use the IRR criterion, while the CFO favors the NPV method.You were hired to advise Murray on the best procedure.If the wrong decision criterion is used, how much potential value would Murray lose?

Definitions:

Persecutions

Systematic mistreatment of an individual or group by another group, often due to political, religious, or ethnic differences.

Lynchings

Extrajudicial killings, usually by hanging, carried out by a mob or group of people without legal authority, historically associated with the suppression of black people in the United States.

Federal Surveyors

Government-employed experts who map and measure land, defining boundaries and assessing terrains for various purposes, including land development and conservation.

Rocky Mountains

A major mountain range in western North America, extending from Canada through the United States, known for its breathtaking landscapes and diverse ecosystems.

Q10: Refer to Exhibit 9.1.What is the best

Q15: The IRR method is based on the

Q26: The capital budget of Creative Ventures Inc.is

Q27: Which of the following statements is CORRECT?<br>A)

Q28: Last year Baron Enterprises had $350 million

Q42: Burke Tires just paid a dividend of

Q55: If D? = $2.25, g (which is

Q74: If a firm's expected growth rate increased

Q77: The overriding goal of inventory management is

Q96: Short-term marketable securities are held for two