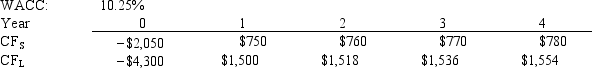

Projects S and L, whose cash flows are shown below, are mutually exclusive, equally risky, and not repeatable.Hooper Inc.is considering which of these two projects to undertake.If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the project with the higher IRR will also have the higher NPV, so no value will be lost if the IRR method is used.

Definitions:

Erogenous Zone

Areas of the human body that are particularly sensitive to stimulation and can lead to sexual arousal when touched or stimulated.

Psychosexual Stage

Periods in Sigmund Freud's theory during which a child's pleasure-seeking energies focus on specific areas of the body leading to personality development.

Displacement

A defense mechanism where emotional impulses are redirected from the original source to a non-threatening target.

Aggressive Impulses

Innate drives or tendencies to act or react in a hostile or violent manner towards others or oneself.

Q1: Which of the following is NOT normally

Q8: The finding that hippocampal inactivation selectively eliminated

Q11: Kenny Electric Company's noncallable bonds were issued

Q19: Firms generally choose to finance temporary current

Q21: The component costs of capital are market-determined

Q29: Barnette Inc.'s free cash flows are expected

Q56: The NPV method's assumption that cash inflows

Q68: Firms raise capital at the total corporate

Q70: Whaley & Whaley has the following data.What

Q92: As a consultant to Basso Inc., you