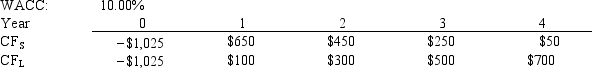

Markman & Sons is considering Projects S and L.These projects are mutually exclusive, equally risky, and not repeatable and their cash flows are shown below.If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the project with the higher IRR will also have the higher NPV, i.e., no conflict will exist.

Definitions:

Multiple Intelligences

A theory proposing that intelligence is not a single entity but rather comprises several distinct types of cognitive abilities.

Mathematical Ability

The capacity to understand, manipulate, and solve numerical and logical problems.

Genetic Component

The part of a characteristic or disease risk attributed to variations or mutations in genes.

Fluid Intelligence

The aspect of human intelligence that involves the ability to solve new problems, use logic in novel situations, and identify patterns.

Q7: A company's perpetual preferred stock currently sells

Q8: The tighter the probability distribution of its

Q25: McPherson Company must purchase a new milling

Q26: Braddock Construction Co.'s stock is trading at

Q35: You have a portfolio P that consists

Q57: Noddings Inc.needs to raise more capital because

Q57: Sensitivity analysis measures a project's stand-alone risk

Q64: If D? = $1.25, g (which is

Q111: The relative profitability of a firm that

Q133: Data for Atwill Corporation is shown below.Now