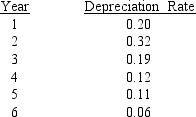

McPherson Company must purchase a new milling machine.The purchase price is $50, 000, including installation.The machine has a tax life of 5 years, and it can be depreciated according to the following rates.The firm expects to operate the machine for 4 years and then to sell it for $12, 500.If the marginal tax rate is 40%, what will the after-tax salvage value be when the machine is sold at the end of Year 4?

Definitions:

Tosses

In a statistical context, refers to the act of flipping a coin to produce random outcomes of heads or tails.

Binomial Distribution

A probability distribution that summarizes the likelihood of a variable to take one of two independent values under a given set of parameters.

Probability Of Success

The likelihood that a specified event or outcome will occur, often utilized in the context of trials or experiments.

Variance

A measure of the dispersion, indicating how far individual numbers in a set are from the mean.

Q9: Which of the following statements is CORRECT?<br>A)

Q10: Refer to Exhibit 9.1.What is the best

Q22: Suppose Stackpool Inc.had inventory in Britain valued

Q22: In your internship with Lewis, Lee, &

Q29: The cost of preferred stock to a

Q30: Projects A and B have identical expected

Q40: Poff Industries' stock currently sells for $120

Q42: Studies have found that monkeys and rats

Q49: The Jameson Company just paid a dividend

Q80: If a firm's stockholders are given the