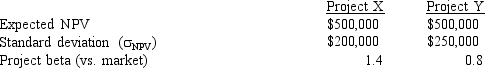

Tallant Technologies is considering two potential projects, X and Y.In assessing the projects' risks, the company estimated the beta of each project versus both the company's other assets and the stock market, and it also conducted thorough scenario and simulation analyses.This research produced the following data:

Correlation of the project cash flows with cash flows from currently existing projects.Cash flows are not correlated with the cash flows from existing projects.Cash flows are highly correlated with the cash flows from existing projects.

Which of the following statements is CORRECT?

Definitions:

Personality Test

A questionnaire or other standardized instrument designed to reveal aspects of an individual's character or psychological makeup.

Established Standards

Officially recognized criteria or benchmarks that are widely accepted and used as a basis for comparison or judgment.

Criterion Validity

The extent to which a measure is related to an outcome or, more specifically, the effectiveness of a test in predicting an individual's behavior in specific contexts.

Psychological Test

A standardized measure of a sample of a person's behavior or mental processes.

Q7: Two constant growth stocks are in equilibrium,

Q8: Suppose 1 U.S.dollar equals 1.60 Canadian dollars

Q15: A Eurodollar is a U.S.dollar deposited in

Q17: The United States and most other major

Q18: Burnham Brothers Inc.has no retained earnings since

Q20: Since investors tend to dislike risk and

Q31: For a zero-growth firm, it is possible

Q42: Typically, a project will have a higher

Q46: As a rule, managers should try to

Q139: Stock A's beta is 1.7 and Stock