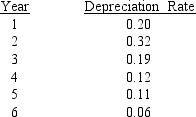

McPherson Company must purchase a new milling machine.The purchase price is $50, 000, including installation.The machine has a tax life of 5 years, and it can be depreciated according to the following rates.The firm expects to operate the machine for 4 years and then to sell it for $12, 500.If the marginal tax rate is 40%, what will the after-tax salvage value be when the machine is sold at the end of Year 4?

Definitions:

Young Adults

Individuals in their late teens to mid-twenties, often considered a critical period for personal development and independence.

Sternberg

Often related to Robert Sternberg, an American psychologist known for his theory on love and intelligence.

Intimacy

The experience of warmth toward another person that arises from feelings of closeness and connectedness.

Passion

Intense romantic or sexual desire for another person.

Q20: Which of the following statements is CORRECT?<br>A)

Q26: Refer to Exhibit 9.1.What is the best

Q26: Refer to Exhibit 15.3.BB is considering moving

Q27: The Lincoln Company sold a $1, 000

Q28: Which of the following statements is CORRECT?

Q37: Consider the following information and then calculate

Q55: Which of the following statements is correct?<br>A)

Q85: A promissory note is the document signed

Q105: Current Design Co.is considering two mutually exclusive,

Q134: Consider the following information for three stocks,