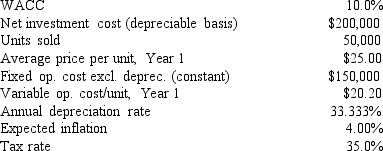

Sylvester Media is analyzing an average-risk project, and the following data have been developed.Unit sales will be constant, but the sales price should increase with inflation.Fixed costs will also be constant, but variable costs should rise with inflation.The project should last for 3 years, it will be depreciated on a straight-line basis, and there will be no salvage value.This is just one of many projects for the firm, so any losses can be used to offset gains on other firm projects.The marketing manager does not think it is necessary to adjust for inflation since both the sales price and the variable costs will rise at the same rate, but the CFO thinks an adjustment is required.What is the difference in the expected NPV if the inflation adjustment is made vs.if it is not made?

Definitions:

Agenda Items

Specific topics or issues to be discussed or acted upon during a meeting.

Issue Development

The process by which concerns or problems are identified, defined, and evolved for discussion or resolution.

Double-Edged Effect

A situation or strategy that has both positive and negative outcomes or implications.

Overconfidence

A cognitive bias where a person's subjective confidence in their judgments is greater than the objective accuracy of those judgments.

Q4: Mark Packard and James McGaugh's 1996 research

Q11: Which of the following should be considered

Q17: Shultz Business Systems is analyzing an average-risk

Q20: Firms HD and LD are identical except

Q24: David works for an advertising firm and

Q60: Connor Publishing's preferred stock pays a dividend

Q72: Short-term financing is riskier than long-term financing

Q83: Which of the following statements is CORRECT?<br>A)

Q124: A firm's peak borrowing needs will probably

Q132: Charlie and Lucinda each have $50, 000