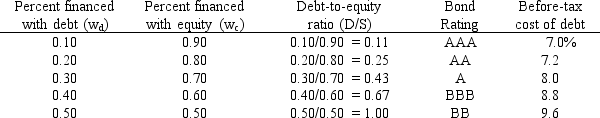

LeCompte Learning Solutions is considering making a change to its capital structure in hopes of increasing its value.The company's capital structure consists of debt and common stock.In order to estimate the cost of debt, the company has produced the following table:

The company uses the CAPM to estimate its cost of common equity, rs.The risk-free rate is 5% and the market risk premium is 6%.LeCompte estimates that if it had no debt its beta would be 1.0.(Its "unlevered beta, " bU, equals 1.0.) The company's tax rate, T, is 40%.

On the basis of this information, what is LeCompte's optimal capital structure, and what is the firm's cost of capital at this optimal capital structure?

Definitions:

Alpha Motor Neurons

Nerve cells that innervate muscle fibers, responsible for initiating muscle contraction.

Muscle Spindle

A sensory receptor located in muscles that senses changes in muscle length and contributes to the control of muscle contraction.

Afferent Neurons

Nerve cells that carry sensory information from the body's periphery to the central nervous system.

Stretch Reflex

A muscle contraction in response to stretching within the muscle, serving as a protective mechanism to prevent overstretching.

Q6: Compare and contrast correlational and experimental approaches

Q21: An investor who writes standard call options

Q23: Which of the following statements is CORRECT?<br>A)

Q24: The value of Broadway-Brooks Inc.'s operations is

Q29: Perceptual memories are specific to _.<br>A) a

Q31: For a zero-growth firm, it is possible

Q32: LeCompte Learning Solutions is considering making a

Q39: The WACC for two mutually exclusive projects

Q42: Refer to Exhibit 15.4.The firm is considering

Q56: Firms hold cash balances in order to