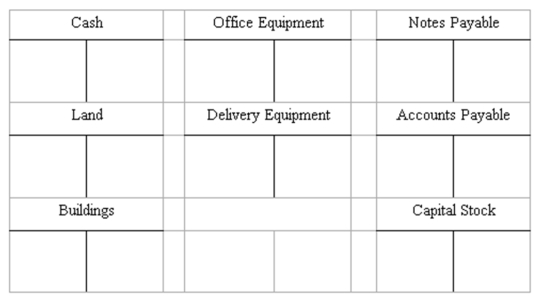

Recording transactions directly in T accounts; trial balance

On July 20, Mollie Rose began a new business called MR Printing, which provides typing, duplicating, and printing services. The following six transactions were completed by the business during July.

(A.) Issued to Rose 1,000 shares of capital stock in exchange for her investment of $200,000 cash.

(B.) Purchased land and a small building for $450,000, paying $165,000 cash and signing a note payable for the balance. The land was considered to be worth $240,000 and the building $210,000.

(C.) Purchased office equipment for $30,000 from Quality Interiors, Inc. Paid $17,000 cash and agreed to pay the balance within 60 days.

(D.) Purchased a motorcycle on credit for $3,400 to be used for making deliveries to customers. Mollie agreed to make payment to Spokes, Inc. within 10 days.

(E.) Paid in full the account payable to Spokes, Inc.

(F.) Borrowed $30,000 from a bank and signed a note payable due in six months.

Instructions

(A.) Record the above transactions directly in the T accounts below. Identify each entry in a T account with the letter shown for the transaction. This exercise does not call for the use of a journal.

(B.) Prepare a trial balance at July 31 by completing the form provided.

MR PRINTING

MR PRINTING

Trial Balance

July 31, 20

Debit Credit

Definitions:

Indefinite Useful Life

An intangible asset that is not expected to deplete over a measurable period of time, and hence is not amortized.

Consolidated Income Statement

A financial statement that shows the aggregate operating results of a parent company and its subsidiaries as if the group were a single entity.

FVE Method

FVE Method, or Fair Value Estimation Method, involves estimating the fair value of an asset or liability, taking into account market conditions and other influencing factors.

Equity Method

An accounting technique used when a company invests in another company and has significant influence, typically reflected by owning 20% to 50% of the voting stock, whereby the investment is initially recorded at cost and subsequently adjusted for the investing company's share of the investee's net profits or losses.

Q1: What is the total debits on the

Q8: In a trial balance prepared on January

Q33: According to the Sarbanes-Oxley Act of 2002,

Q40: An inexperienced accounting intern at Tasso

Q68: The matching principle:<br>A) Applies only to situations

Q82: Partial balance sheets and additional information

Q86: Adjusting entries are needed:<br>A) Whenever revenue is

Q120: A statement of retained earnings shows:<br>A) The

Q134: Partial balance sheets and additional information

Q153: Recording transactions in T accounts; trial balance<br>On