Typical Corp. reported a deferred tax liability of $6,000,000 for the year ended December 31, 2008, when the tax rate was 40%. The deferred tax liability was related to a temporary difference of $15,000,000 caused by an installment sale in 2008. The temporary difference is expected to reverse in 2010 when the income deferred from taxation will become taxable. There are no other temporary differences. Assume a new tax law passed in 2009 and the tax rate, which will remain at 40% for through December 31, 2009, will become 48% for tax years beginning after December 31, 2009. Taxable income for the year 2009 is $30,000,000.

Required:

Prepare two footnotes for Typical's year 2009 financial statements to:

(a.) Show the composition of Typical's income tax expense for the year.

(b.) Explain the classification and description of the deferred tax liability.

Give supporting computations to show how you arrived at the dollar amounts disclosed in your footnotes.

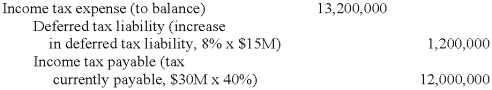

Students may show the journal entry for the year 2009 tax provision as supporting detail:

Definitions:

Hippocampus

A critical region of the brain involved in memory formation and spatial navigation.

Spatial Memory

The part of memory responsible for recording information about one's environment and its spatial orientation, allowing for navigation in a physical space.

Long-term Retention

The ability to maintain and utilize information over extended periods of time, significant for learning and memory.

Epinephrine

Also known as adrenaline, a hormone and neurotransmitter involved in regulating visceral functions (e.g., heart rate, blood pressure) and in the body's fight-or-flight response.

Q6: Which of the following causes a permanent

Q24: During 2009, Deluxe Leather Goods sold 800,000

Q28: The cost of customer premium offers should

Q33: Assume that at the beginning of the

Q35: When accounting for pensions, delayed recognition of

Q42: At the beginning of 2009, Angel Corporation

Q47: Four independent situations are described below. Each

Q76: What is the service cost to be

Q83: Determine the price of a $500,000

Q135: Silver Springs Company has an unfunded retiree