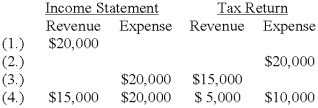

Four independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences reported first on:

Required:

For each situation, determine the taxable income assuming pretax accounting income is $100,000. Show well-labeled computations.

Definitions:

Mailed Questionnaires

A survey method involving sending questionnaires through postal mail to gather data from respondents, used in research studies.

Clinical

Pertaining to the observation, diagnosis, and treatment of patients, especially in a healthcare setting.

Mental Health

The state of well-being in which an individual realizes their own abilities, can cope with the normal stresses of life, can work productively, and is able to make contributions to their community.

Social Exchange Perspective

A theory in social science that assumes human relationships are formed by the use of a subjective cost-benefit analysis and the comparison of alternatives.

Q2: If Ziggy Company concluded that an investment

Q17: If no estimates are changed and there

Q22: When an impairment of securities available for

Q26: A bargain purchase option is defined as

Q38: What was General's coupon promotional expense in

Q38: Hawk Corporation purchased ten thousand shares of

Q61: During the current year, High Corporation had

Q74: What is the difference between a stock

Q92: What was the net pension asset /

Q111: Which of the following would never require