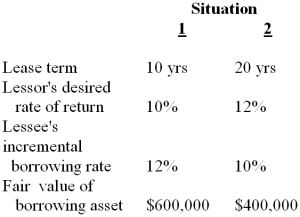

Each of the independent situations below describes a nonoperating lease in which annual lease payments are payable at the beginning of each year. The lessee is aware of the lessor's implicit interest rate.

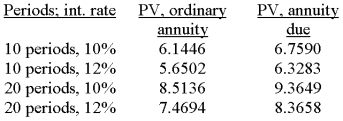

For convenience, here are some table values:

Required:

For each situation determine the amount of the annual lease payment, as calculated by the lessor.

Definitions:

TANF

A program funded by the federal government in the United States, Temporary Assistance for Needy Families assists impoverished families in reaching self-reliance.

Foreign-Born

Individuals who were born outside of the country in which they currently live, excluding those who were born to parents stationed abroad as part of diplomatic or military service.

Earmarked Payroll Taxes

Taxes collected for a specific purpose, typically to fund social security and healthcare programs, and directly deducted from an employee's wages.

Q4: Holding gains and losses on trading securities

Q17: In terms of business volume, the dominant

Q18: Nichols Enterprises has an investment in 25,000

Q28: Four independent situations are described below. Each

Q50: The estimated medical costs are expected to

Q71: Franklin's taxable income ($ in millions) is:<br>A)$

Q91: Goofy Inc. bought 15,000 shares of Crazy

Q102: What should Hobson International report as income

Q115: A reconciliation of pretax financial statement income

Q121: Investments in securities to be held for