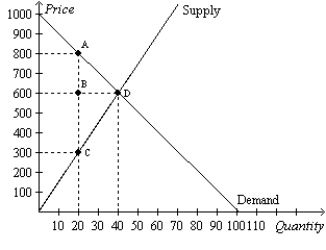

Figure 8-9

The vertical distance between points A and C represents a tax in the market.

-Refer to Figure 8-9.The amount of amount of deadweight loss as a result of the tax is

Definitions:

Manufacturing Cost

The total expense incurred in the process of producing a product, including raw materials, labor, and overhead costs.

General and Administrative

Expenses related to the day-to-day operations of a business that are not directly tied to production, including salaries of non-production staff, office supplies, and rent.

Direct Materials

Raw materials that are directly traceable to the production of a specific good or product.

Prime Costs

Refers to the direct costs of manufacturing a product, including direct materials and direct labor.

Q1: Refer to Figure 8-9.The amount of tax

Q28: Refer to Figure 8-22.Suppose the government changed

Q39: If the government levies a $500 tax

Q53: Which of the following statements is correct

Q69: Refer to Figure 8-8.After the tax goes

Q104: Refer to Figure 7-23.The equilibrium price is<br>A)P1.<br>B)P2.<br>C)P3.<br>D)P4.

Q124: Refer to Figure 8-7.Suppose a 20<sup>th</sup> unit

Q151: The supply curve for motor oil is

Q188: Refer to Figure 6-25.The equilibrium price in

Q203: When a good is taxed,<br>A)both buyers and