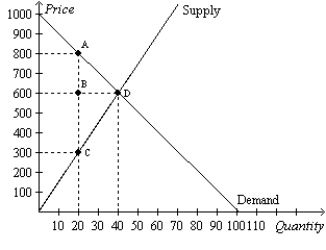

Figure 8-9

The vertical distance between points A and C represents a tax in the market.

-Refer to Figure 8-9.The amount of tax revenue received by the government is

Definitions:

Absorption Costing

An accounting method that includes both variable and fixed manufacturing costs in the cost of a product, used for external reporting.

Unit Product Cost

The combined sum of fixed and variable expenses incurred in the creation of one unit of a product.

Absorption Costing

A costing method that includes all manufacturing costs - direct materials, direct labor, and both variable and fixed manufacturing overhead - in the cost of a product.

Total Gross Margin

The difference between the sales revenue and the cost of goods sold, indicating the total profitability from goods sold.

Q1: At Nick's Bakery,the cost to make homemade

Q2: Refer to Figure 8-22.Suppose the government changed

Q32: If the demand for light bulbs increases,producer

Q40: Jeff decides that he would pay as

Q57: The deadweight loss from a tax of

Q59: A seller is willing to sell a

Q66: Refer to Figure 7-23.If the price were

Q146: Refer to Figure 8-6.When the tax is

Q182: Refer to Figure 8-4.The amount of deadweight

Q247: Some goods can be produced at low