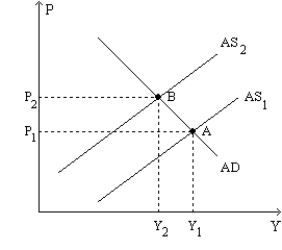

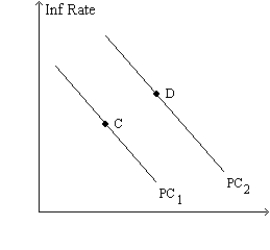

Figure 35-9.The left-hand graph shows a short-run aggregate-supply (SRAS) curve and two aggregate-demand (AD) curves.On the right-hand diagram,"Inf Rate" means "Inflation Rate."

-Refer to Figure 35-9.Faced with the shift of the Phillips curve from PC1 to PC2,policymakers will

Definitions:

Financing Activities

Transactions and events where funds are raised for the company, which may include issuing stocks, bonds, or taking out loans, affecting the equity and debt of the business.

Cash Flow

A measurement of the net amount of cash and cash-equivalents being transferred into and out of a business.

Common Stock

A form of corporate equity ownership, a type of security representing ownership in a corporation and a claim on part of the corporation's profits.

Statement of Cash Flows

A financial overview showing the cumulative cash inflows from a company's daily operations and investment receipts, against the total cash outlays for operational and investment expenditures during a nominated period.

Q1: Refer to Figure 4-5.Which of the following

Q27: Samuelson and Solow reasoned that when aggregate

Q33: Which of the following is correct if

Q36: If the short-run Phillips curve were stable,which

Q38: During recessions,taxes tend to<br>A)rise and thereby increase

Q56: If a central bank reduced inflation by

Q65: The natural rate of unemployment<br>A)is constant over

Q66: Refer to Figure 4-7.The movement from Da

Q69: Refer to Figure 34-7.Which of the following

Q99: According to the long-run Phillips curve,in the