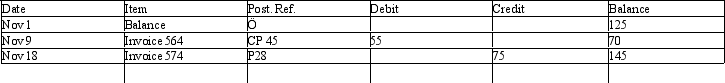

The debits and credits from two transactions are presented in the following supplier's (creditor's) account:

NAME: Xample, Inc.

Address: 567 Harrison Blvd.

Describe each transaction and the source of each posting.

Describe each transaction and the source of each posting.

Definitions:

Net Income

The residual income of a business following the subtraction of all taxes and costs from the total revenue.

Gross Profit

The financial metric calculated as sales revenue minus the cost of goods sold, indicating the efficiency of a company in producing and selling its goods.

Sales Discounts

Reductions in the sales price offered by a seller to a buyer, often to prompt early payment or bulk purchases.

Accounts Receivable Turnover Ratio

A financial metric indicating how efficiently a company collects cash from its credit customers by measuring how often receivables are collected during a period.

Q21: Briefly describe the three-step process of accounting

Q22: The total of the accounts receivable subsidiary

Q54: Under the periodic inventory system, the cost

Q62: Some of the more common subsidiary ledgers

Q91: Short-term liabilities are those liabilities that<br>A) will

Q124: Each of the following transactions for Morrison

Q128: What type of company would normally offer

Q149: Sampson Co. sold merchandise to Batson Co.

Q174: Title to merchandise shipped FOB shipping point

Q198: A company using the periodic inventory system