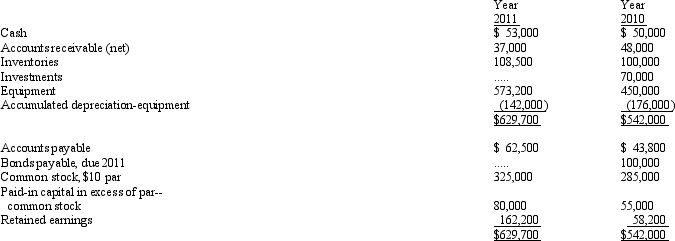

The comparative balance sheet of Posner Company, for 2011 and the preceding year ended December 31, 2010, appears below in condensed form:

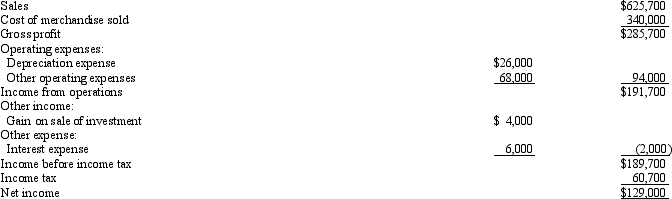

The income statement for the current year is as follows:

The income statement for the current year is as follows:

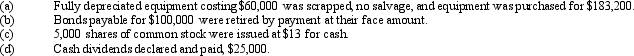

Additional data for the current year are as follows:

Additional data for the current year are as follows:

Prepare a statement of cash flows, using the indirect method of reporting cash flows from operating activities.

Prepare a statement of cash flows, using the indirect method of reporting cash flows from operating activities.

Definitions:

Annuities

Financial products that provide a stream of payments over time to the holder, often used for retirement purposes.

Retirement Years

The period of life after one ceases working full time based on achieving a certain age or financial status.

Annual Return

The percentage change in an investment's value over a one-year period, including any dividends or interest, reflecting the compound annual growth rate.

Annual Return

The percentage change in the value of an investment over one year, taking into account both price increases and income received from the investment.

Q3: The following information was taken from the

Q13: Dennis Corp. issued $2,500,000 of 20-year, 9%

Q42: Match the following stockholders equity concepts to

Q57: The Sharpe Company reports the following information

Q83: On February 12, Addison, Inc. purchased 6,000

Q87: The balance in Retained Earnings at the

Q90: Product costs are also referred to as

Q100: The following are all product costs except:<br>A)

Q159: Accounts receivable from sales transactions were $51,000

Q184: The following information pertains to Carlton Company.