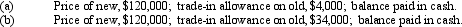

Machinery acquired at a cost of $80,000 and on which there is accumulated depreciation of $55,000 (including depreciation for the current year to date) is exchanged for similar machinery. For financial reporting purposes, present entries to record the disposition of the old machinery and the acquisition of new machinery under each of the following assumptions:

Definitions:

Material

A substance or substances from which something is or can be made.

Nucleus

The cell's central organelle, containing most of its genetic material.

Cellular Activities

Various processes and reactions that occur within a living cell, crucial for the cell's survival and function, such as metabolism, protein synthesis, and cell division.

Control

In experimental settings, a standard condition against which the effects of a variable are compared.

Q3: What are nonfinancial rewards,and what are the

Q16: Tomas and Saturn are partners who share

Q32: The fundamental principles guiding the design and

Q49: Frame of reference training involves discussing the

Q58: Self-appraisals should not be used as the

Q101: A characteristic of a fixed asset is

Q128: Assuming a 360-day year, when a $30,000,

Q129: Medicare taxes are paid by both the

Q142: For income tax purposes most companies use

Q167: Notes may be issued<br>A) when assets are