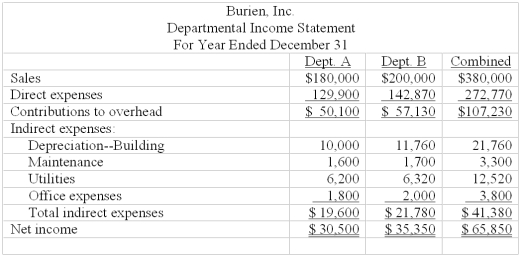

Burien, Inc. operates a retail store with two departments, A andB. Its departmental income statement for the current year follows:

Burien allocates building depreciation, maintenance, and utilities on the basis of square footage. Office expenses are allocated on the basis of sales.

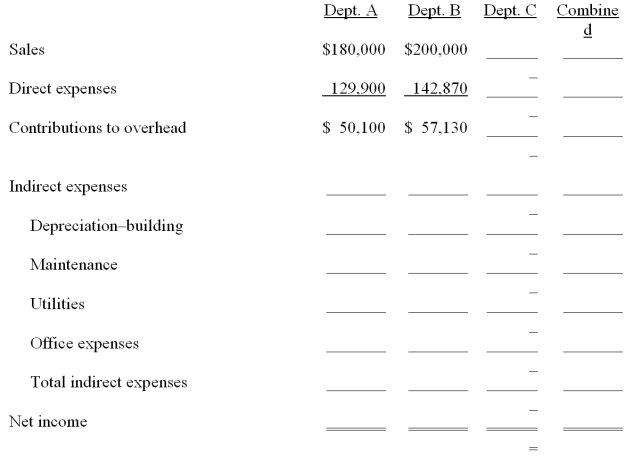

Management is considering an expansion to a three-department operation. The proposed Department C would generate $120,000 in additional sales and have a 17.5% contribution to overhead. The company owns its building. Opening Department C would redistribute the square footage to each department as follows: A, 19,040; B, 21,760 sq. ft.; C, 13,600. Increases in indirect expenses would include: maintenance, $500; utilities, $3,800; and office expenses, $1,200.

Complete the following departmental income statements, showing projected results of operations for the three sales departments. (Round amounts to the nearest whole dollar.)

Definitions:

Unpleasant Emotions

refer to feelings that are not enjoyable or comfortable, such as sadness, anger, or fear, often resulting from negative experiences.

Perceiver's Experience

The influence of an individual's own knowledge, beliefs, and emotions on how they interpret and respond to different stimuli or situations.

Perceptions

The process of organizing and interpreting sensory information to understand and interact with the environment.

Perceptions

Perceptions are the ways in which individuals interpret and understand their environment and experiences, influenced by their own beliefs, thoughts, and feelings.

Q4: The pressure P acting at a

Q8: What is a merchandise purchases budget? How

Q28: Fixed budgets are also known as flexible

Q35: Samm's Department Store operates three departments (A,

Q43: A company expects to produce and

Q50: Given the following data, total product

Q84: Which of the following factors is least

Q85: When excess capacity exists, what is the

Q112: If Teague wishes to earn $1,250 on

Q125: A company wishes to buy new