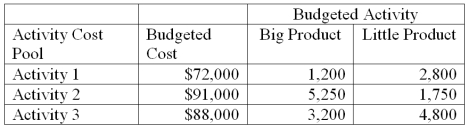

A company has two products: Big and Little. It uses activity-based costing and has prepared the following analysis showing budgeted cost and activity for each of its three activity cost pools.

Annual production and sales level of big product is 62,525 units, and the annual production and sales level of little product is 251,900 units.

(a.) Compute the approximate overhead cost per unit of big product under activity-based costing.

(b.) Compute the approximate overhead cost per unit of little product under activity-based costing.

Definitions:

Personal ties

Relationships between individuals that are based on emotional bonds, shared experiences, or mutual interests.

Divorce

The legal dissolution of a marriage by a court or other competent body, officially ending the relationship.

Divorce rates

The statistical measure of the number of divorces occurring within a defined population during a given time period.

Stepchildren

Children of one's spouse from a previous relationship.

Q7: If Department Q uses $60,000 of direct

Q36: Activity-based costing eliminates the need for overhead

Q60: A product sells for $210 per unit,

Q87: Contribution margin ratio is the percent of

Q96: Process cost accounting systems consider overhead costs

Q105: Medlar Corp. maintains a Web-based general ledger.

Q107: The following information describes a product

Q118: The contribution margin per unit is the

Q141: Cost-volume-profit analysis provides approximate, but not precise,

Q166: After posting all actual factory overhead and