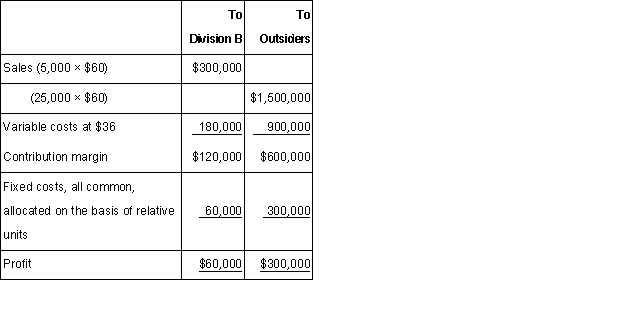

Division A of Spangler Company expects the following results:

Division B has the opportunity to buy its needs of 5,000 units from an outside supplier at $45 each.Assume that Division A cannot increase sales to outsiders.Required:

a.What would be the optimal transfer price?

b.Assume that Spangler allows the divisional managers to negotiate transfer prices.What would the maximum transfer price be?

c.Assume that Spangler allows the divisional managers to negotiate transfer prices.What would the minimum transfer price be?

Definitions:

Development Costs

Expenses associated with the development of new products, services, or processes.

Future Impact

The potential effects or consequences of actions, decisions, or events on the future.

Efficiency Wages

The theory that employers may pay wages above the market rate to increase worker productivity, reduce turnover, and encourage loyalty.

Employee Turnover

The rate at which employees leave a workforce and are replaced by new employees.

Q8: The asset turnover is a measure (ratio)of

Q9: What are the differences between strategic planning

Q23: If a division is evaluated using return

Q65: Explain the difference between fixed compensation and

Q70: Which of the following statements is(are)true regarding

Q85: Briefly discuss some of the general issues

Q96: Big Sky Industries is a division

Q103: Seaside Resorts operates a centralized call

Q113: Vegas Manufacturing uses a standard cost

Q127: Kevin Montgomery Retail seeks your assistance