Figure:

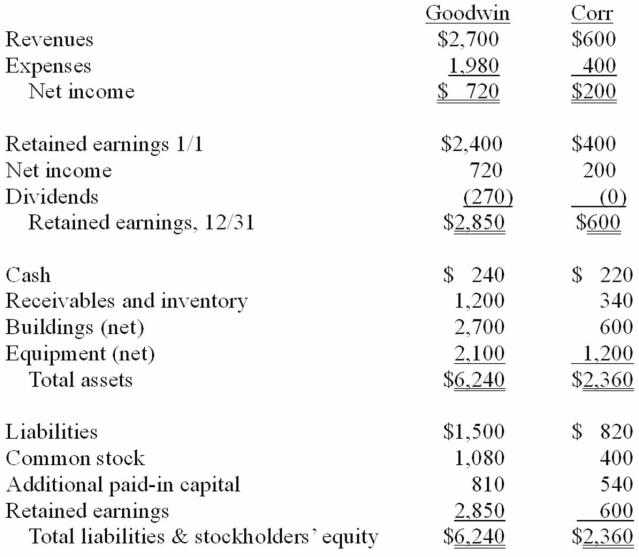

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated revenues for 20X1.

Definitions:

Food Lion Feeds

A charitable initiative by the grocery store chain Food Lion, aimed at addressing hunger and food insecurity by donating meals to those in need.

Talent Recruitment

The process of identifying, attracting, and hiring individuals with the necessary skills and attributes for organizational roles.

CSR

Corporate Social Responsibility (CSR) refers to a company's initiatives to assess and take responsibility for its impacts on environmental and social wellbeing, often going beyond what might be required by regulators or environmental protection groups.

Millennials

A generational cohort following Generation X, typically referring to people born from the early 1980s to the late 1990s, known for their unique consumption patterns and digital fluency.

Q1: OPEC is an example of a(n)_ because

Q10: In order for women to have a

Q20: Davidson,Inc.owns 70 percent of the outstanding voting

Q27: What is the amount of unrealized intra-entity

Q55: If push-down accounting is not used,what amounts

Q62: What amount of equity income should Deuce

Q67: Citizens of a given ethnic background are

Q81: Which one of the following is a

Q95: Compute the consolidated revenues for 20X1.<br>A)$2,700.<br>B)$720.<br>C)$920.<br>D)$3,300.<br>E)$1,540.

Q114: What balances would need to be considered