Figure:

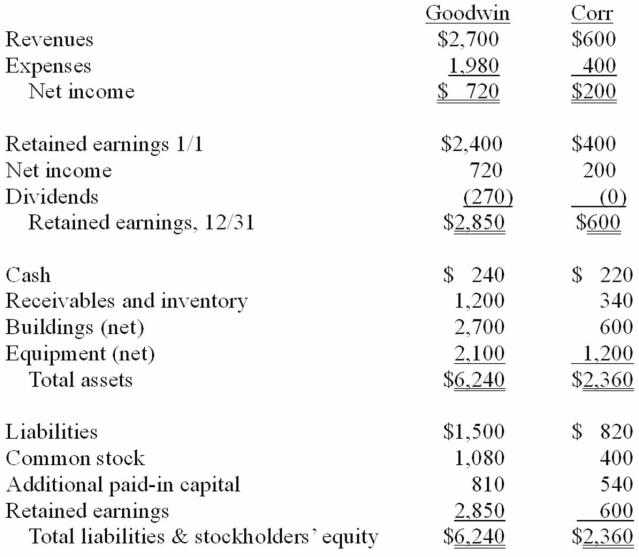

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated expenses for 20X1.

Definitions:

Negative

A term indicating the absence of a property or condition, often used in contrast to its presence.

Argue

To present reasons for or against something in a discussion or debate.

Contemporary Psychology

The study of behavior and mental processes using modern theories and methodologies.

Physiological Psychology

A subfield of psychology that studies the physiological bases of psychological processes and behaviors.

Q4: Democracies almost always fight wars against each

Q13: Former U.S.Defense Secretary William Cohen's statement,"The unrelenting

Q18: Idler Co.has an investment in Cowl Corp.for

Q30: In consolidation at December 31,2010,what adjustment is

Q88: Which of the following is not a

Q88: An intra-entity sale took place whereby the

Q91: On January 1,2011,Spark Corp.acquired a 40% interest

Q108: In the consolidation worksheet for 2011,assuming Carter

Q110: What accounting method requires a subsidiary to

Q112: What is the adjusted book value of