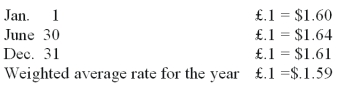

Westmore, Ltd. is a British subsidiary of a U.S. company. Westmore's functional currency is the pound sterling. The following exchange rates were in effect during 2011:

-On December 31, 2011, Westmore had accounts receivable of 280,000. What amount (rounded) would have been included for this subsidiary in calculating consolidated accounts receivable?

Definitions:

Inequality

The unequal distribution of resources, opportunities, and rights among individuals and groups in a society.

Cultural Appropriation

The adoption or use of elements of one culture by members of another culture, often without permission and/or understanding, which can lead to controversy and debate over issues of respect, identity, and intellectual property.

Indigenous Cultures

The customs, social practices, and ways of life of native groups who have historically inhabited regions, often with distinct languages, traditions, and connections to the land.

Financial Interests

Investments or stakes in financial assets or ventures that carry potential for financial gain or loss.

Q2: Which one of the following regulates the

Q8: If the land is sold for $450,000,

Q25: What amount should have been reported for

Q31: Under the current rate method, inventory at

Q38: How much foreign exchange gain or loss

Q44: When a city received a private donation

Q58: Compute the fair value of the foreign

Q72: Where do dividends paid by a subsidiary

Q94: Required:<br>Prepare a schedule to show Kurton's share

Q107: What is the noncontrolling interest in Gamma's