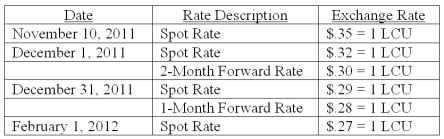

On November 10, 2011, King Co. sold inventory to a customer in a foreign country. King agreed to accept 96,000 local currency units (LCU) in full payment for this inventory. Payment was to be made on February 1, 2012. On December 1, 2011, King entered into a forward exchange contract wherein 96,000 LCU would be delivered to a currency broker in two months. The two month forward exchange rate on that date was 1 LCU = $.30. Any contract discount or premium is amortized using the straight-line method. The spot rates and forward rates on various dates were as follows:  The company's borrowing rate is 12%. The present value factor for one month is .9901.

The company's borrowing rate is 12%. The present value factor for one month is .9901.

-(A) Assume this hedge is designated as a cash flow hedge. Prepare the journal entries relating to the transaction and the forward contract.

(B) Compute the effect on 2011 net income.

(C) Compute the effect on 2012 net income.

Definitions:

Owner

A person or entity that legally possesses an asset, property, or business, and has the right to manage, use, and enjoy it.

Fixed Price

A pricing strategy where the cost of a product or service is set and not subject to change based on fluctuations in the market or demand.

Bonus Pay

Additional compensation given to employees as a reward for achieving specific goals, performance levels, or for exceptional work beyond their regular pay.

Merit Pay

A system of compensation where employees are awarded pay increases or bonuses based on their performance or achievements.

Q7: For consolidation purposes, what amount would be

Q13: The accrual-based income of West Corp. is

Q13: A net asset balance sheet exposure exists

Q15: Which operating segments are reportable under the

Q34: Which of the following is not one

Q57: What is the appropriate treatment in an

Q69: Sparkman Co. filed a bankruptcy petition and

Q89: When Buckette prepared consolidated financial statements, it

Q89: Assume the functional currency is the euro,

Q115: Compute the noncontrolling interest in the net