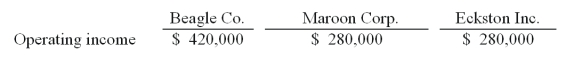

Beagle Co. owned 80% of Maroon Corp. Maroon owned 90% of Eckston Inc. Operating income totals for 2011 are shown below; these figures contained no investment income. Amortization expense was not required by any of these acquisitions. Included in Eckston's operating income was a $56,000 unrealized gain on intra-entity transfers to Maroon.

-The accrual-based income of Maroon Corp. is calculated to be

Definitions:

Md

A command issued from a command prompt that creates a directory (folder) or subdirectory.

Cd

An abbreviation for Cadmium, a chemical element, or Compact Disc, a digital optical data storage format.

Dir

A command in the command-line interface of various operating systems used to list the files and directories in a specific directory.

Proxy Server Configuration

The setup process involving specifying parameters that control the behavior of a proxy server to manage or direct traffic between users and the internet.

Q4: What is a wrap-around filing?

Q13: The accrual-based income of West Corp. is

Q19: What is consolidated net income?<br>A) $229,500.<br>B) $237,000.<br>C)

Q24: Keenan Company has had bonds payable of

Q39: Convergence of accounting standards would not occur

Q44: What adjustment is needed for Webb's investment

Q51: What is the minimum amount of revenue

Q61: When must Form 8-K be filed with

Q87: Under the temporal method, depreciation expense would

Q95: Throughout 2011, Cleveland Co. sold inventory to