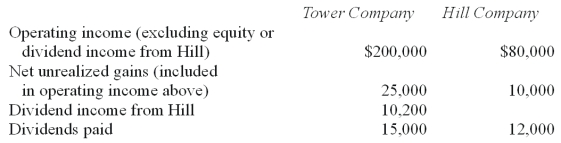

Tower Company owns 85% of Hill Company. The two companies engaged in several intra-entity transactions. Each company's operating and dividend income for the current time period follow, as well as the effects of unrealized gains. No income tax accruals have been recognized within these totals. The tax rate for each company is 30%.

-Using percentage allocation method, how much income tax expense is assigned to Hill?

Definitions:

Mortgage

A loan specifically designed for the purchase of real estate, in which the property itself serves as collateral.

Co-signs

Acts of signing a loan or document jointly with another person, thereby agreeing to share the responsibility for the associated obligations.

Credit Application

A form or process by which an individual or company seeks to obtain credit from a lending institution or creditor.

Interest Rate

the percentage charged on a loan or paid on deposits over a specific period of time, reflecting the cost of borrowing or the reward for saving.

Q8: Which of the following statements is true

Q12: At what amount would consolidated goodwill be

Q13: The accrual-based income of West Corp. is

Q25: What is a proxy? Briefly explain the

Q30: Compute the noncontrolling interest in Smith at

Q38: Which statement is false regarding the Public

Q46: Stevens Company has had bonds payable of

Q66: Compute income from Stiller on Leo's books

Q73: What is Gamma's accrual-based income for 2011?<br>A)

Q103: Prepare any 2011 consolidation worksheet entries that