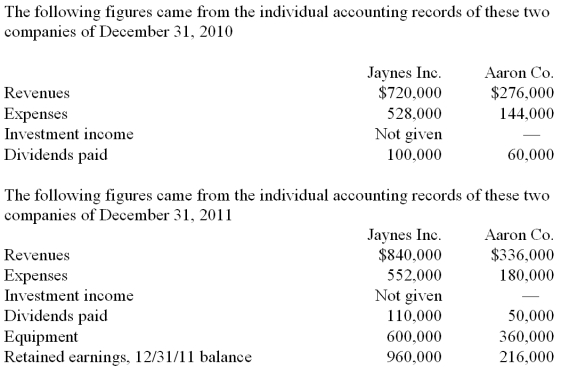

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

-What was consolidated equipment as of December 31, 2011?

Definitions:

Consumption Choice

This refers to the selection of a combination of goods and services that individuals or households decide to consume based on their preferences, income, and prices.

Budget Constraint

A limit on the consumption possibilities of an individual or entity based on available resources.

Optimal Consumption

Describes the combination of goods and services that maximizes an individual's utility or satisfaction subject to their budget constraint.

Marginal Utility

The additional satisfaction or benefit gained from consuming or using one more unit of a good or service.

Q1: Which of the following is/are the benefit(s)

Q7: For consolidation purposes, what amount would be

Q14: Why do intra-entity transfers between the component

Q18: What is the purpose of the adjustments

Q31: In comparing U.S. GAAP and international financial

Q39: What is the consolidated total for inventory

Q39: Stoop's diluted earnings per share (rounded) is

Q41: Compute the consolidated receivables and inventory for

Q74: Compute consolidated revenues at the date of

Q83: The acquisition value attributable to the noncontrolling