Figure:

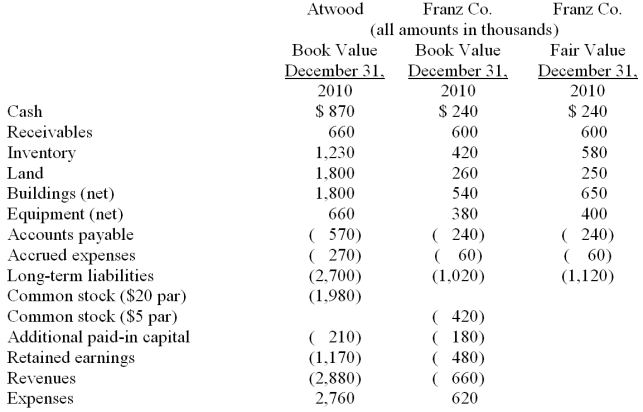

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

-Compute consolidated expenses at date of acquisition.

Definitions:

Women

Adult human females, often discussed in various contexts including biological, social, cultural, and political.

Extravert

A personality trait characterized by outward-directed behaviors, enjoying social interactions, and being energized by spending time with others.

Jung

Carl Jung was a Swiss psychiatrist and psychoanalyst who founded analytical psychology, emphasizing the importance of the individual psyche and the personal quest for wholeness.

Introvert

A person predominantly concerned with their own thoughts and feelings rather than with external things.

Q21: Beta Corp. owns less than one hundred

Q23: Compute Wilson's share of income from Simon

Q26: The balance in the investment account at

Q34: For consolidation purposes, what amount would be

Q49: As an economist working at the

Q76: Compute Pell's investment in Demers at December

Q89: U.S. expenditure shares by households, firms, and

Q108: What was consolidated net income for the

Q117: What is consolidated net income for 2011

Q119: What is the balance in Jackie Corp's