Figure:

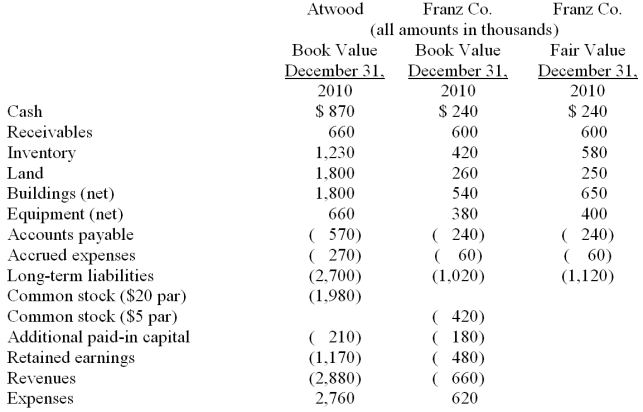

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

-Compute the investment to be recorded at date of acquisition.

Definitions:

Taste Buds

Small sensory organs on the tongue and other parts of the mouth that are sensitive to the taste of food and drink.

Papillae

Small, nipple-like projections on the tongue where taste buds are located.

Eardrum

The taut membrane that transmits the vibrations caused by sound waves from the auditory canal to the ossicles in the middle ear.

Neural Activity

The electrical and chemical processes occurring within neurons that enable brain function, including thought, sensation, and movement.

Q5: Consider the data in Table 2.4. When

Q7: What is the primary accounting difference between

Q30: What is the amount of the excess

Q47: When the fair value option is elected

Q64: Which of the following results in a

Q67: Determine the amortization expense related to the

Q79: If you own your own home, National

Q87: Using the expenditure approach, investment includes:<br>A) household

Q92: You are an economist working for

Q113: Varton Corp. acquired all of the voting