Figure:

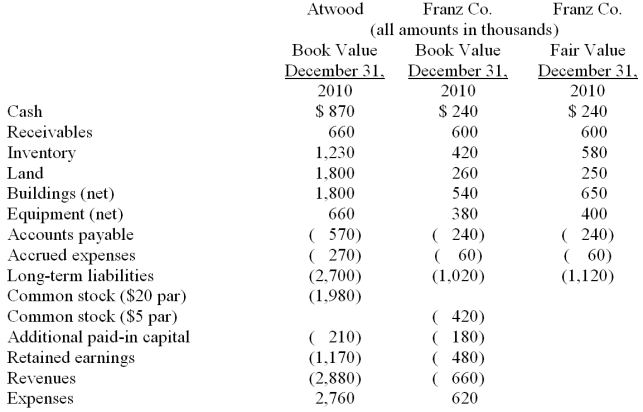

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

-Compute consolidated land at date of acquisition.

Definitions:

Government-sponsored Service

Services provided to the public through funding and direct involvement by government agencies.

Service Quality

The degree to which a service meets or exceeds customer expectations.

Responsiveness

A measure of how quickly and effectively a person, organization, or system reacts to changes or requests.

Service Quality

The perception of the degree to which a service meets the customer's expectations and needs, often assessed through factors like reliability, responsiveness, and empathy.

Q1: GDP measures all economic activity.

Q5: In the Cobb-Douglas production function

Q25: Select True (T) or False (F) for

Q47: What amount will be reported for consolidated

Q54: Describe how this transaction would affect Panton's

Q61: A production function exhibits constant returns to

Q68: The growth rate of any variable

Q88: On January 1, 2009, Rand Corp. issued

Q89: Goodwill is often acquired as part of

Q117: Assuming Gataux generates cash flow from operations