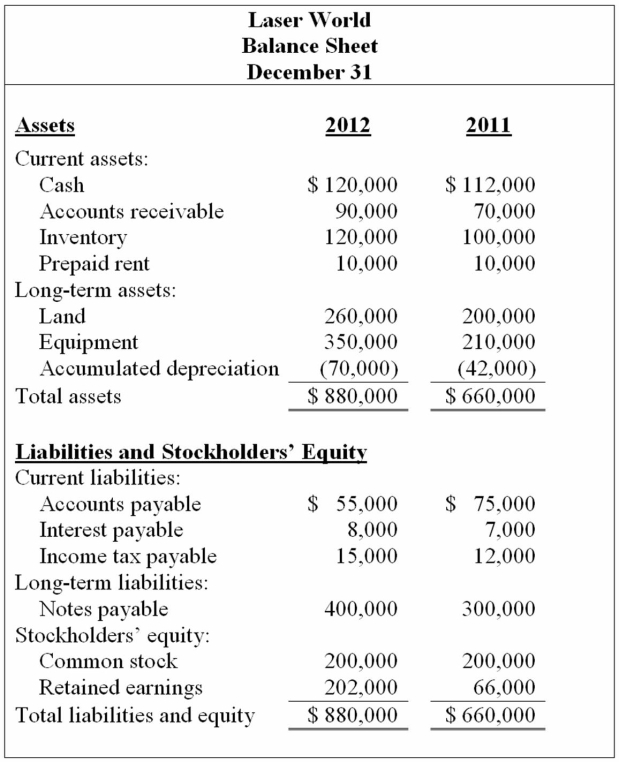

The following income statement and balance sheets for Laser World are provided:  Earnings per share for the year-ended December 31, 2012, is $1.90. The closing stock price on December 31, 2012, is $30.40.

Earnings per share for the year-ended December 31, 2012, is $1.90. The closing stock price on December 31, 2012, is $30.40.

Calculate the following profitability ratios for 2012:

Definitions:

Stem

In the context of a stem-and-leaf plot, it represents the leading digit(s) in a group of numbers which are used to organize and display data graphically.

Histogram

A graphical representation of the distribution of numerical data, where the data are binned and the count for each bin is represented by the height of the bar.

Class Size

The number of students enrolled in a given class or course, often influencing the effectiveness of teaching and learning.

Distribution Tails

The regions at either end of a probability distribution, often of interest for understanding the likelihood of extreme outcomes.

Q10: Which of the following is not considered

Q14: Which organization best serves the professional needs

Q31: At the beginning of the year, Big

Q42: Inventory records for Dunbar Incorporated revealed

Q53: Young Company is involved in a lawsuit.

Q56: Which of the following items is most

Q98: Career opportunities in accounting exist in public

Q108: Footnote disclosure is required for material potential

Q109: T. Boone Pickens football stadium at Oklahoma

Q155: On March 31, 2012, the New