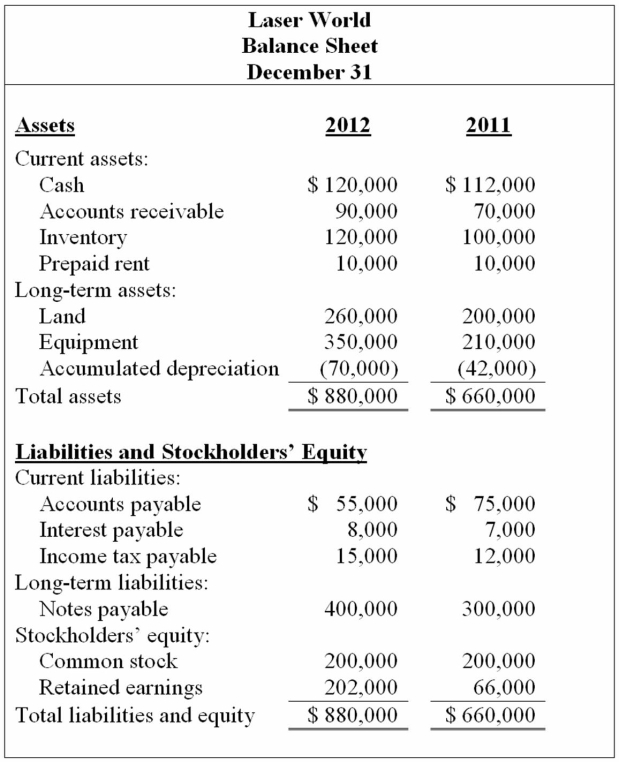

The following income statement and balance sheets for Laser World are provided:  Earnings per share for the year-ended December 31, 2012, is $1.90. The closing stock price on December 31, 2012, is $30.40.

Earnings per share for the year-ended December 31, 2012, is $1.90. The closing stock price on December 31, 2012, is $30.40.

Calculate the following profitability ratios for 2012:

Definitions:

Continuous

Something that occurs without interruption, in automotive terms, can refer to processes or systems that operate unceasingly.

Active

Refers to something currently in operation or in use.

Nonintrusive

A term describing techniques or methods that do not require physical alteration or penetration of a system or object to assess or interact with it.

Monitor

To observe and check the progress or quality of something over a period, often through the use of instruments or sensors.

Q28: Inventory records for Dunbar Incorporated revealed

Q34: A complete set of financial statements for

Q53: Cost of Goods Sold is:<br>A) An asset

Q59: Establishing international accounting standards is the responsibility

Q61: Which of the following is a sign

Q85: Capitalized interest refers to interest costs we

Q89: Which of the following is true?<br>A) The

Q97: On November 1, 2012, The Bagel Factory

Q124: Bricktown Exchange purchases a copyright on January

Q126: Aspen, Inc. developed a new horse transport