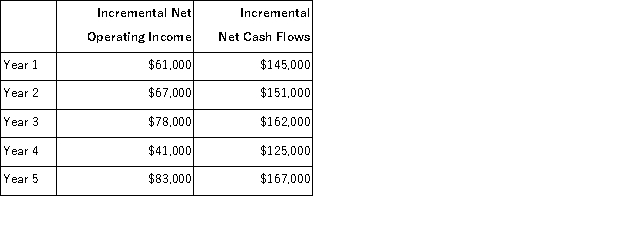

Baldock Inc. is considering the acquisition of a new machine that costs $420,000 and has a useful life of 5 years with no salvage value. The incremental net operating income and incremental net cash flows that would be produced by the machine are:  Assume cash flows occur uniformly throughout a year except for the initial investment. If the discount rate is 12%, the net present value of the investment is closest to:

Assume cash flows occur uniformly throughout a year except for the initial investment. If the discount rate is 12%, the net present value of the investment is closest to:

Definitions:

Spongy Gingiva

A condition where the gums are soft, swollen, and may bleed easily, often a sign of gum disease or infection.

Cheilosis

A condition characterized by the cracking and inflammation of the lips, often due to vitamin B deficiency or fungal infection.

Gag Reflex

A reflex contraction of the back of the throat, evoked by touching the soft palate, designed to prevent choking and aspiration of foreign objects.

Albumin Level

The concentration of albumin (a main protein in blood plasma) in the blood, indicative of nutritional status and liver function.

Q48: The management of Stanforth Corporation is investigating

Q52: Cash payments to repay the principal amount

Q68: The Casket Division of Landazuri Corporation had

Q91: Swaggerty Corporation is considering purchasing a machine

Q120: The Seabury Corporation has a current ratio

Q124: Krech Corporation's comparative balance sheet appears below:

Q159: Dahn Corporation has provided the following financial

Q254: Settles Corporation has provided the following financial

Q268: A high price-earnings ratio means that investors

Q376: Berends Corporation makes a product with the