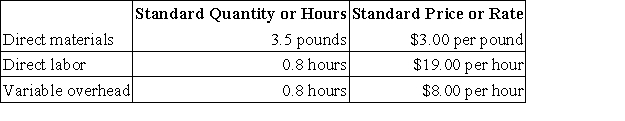

Epley Corporation makes a product with the following standard costs:  In July the company produced 3,300 units using 12,240 pounds of the direct material and 2,760 direct labor-hours. During the month, the company purchased 13,000 pounds of the direct material at a cost of $35,100. The actual direct labor cost was $51,612 and the actual variable overhead cost was $20,148. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

In July the company produced 3,300 units using 12,240 pounds of the direct material and 2,760 direct labor-hours. During the month, the company purchased 13,000 pounds of the direct material at a cost of $35,100. The actual direct labor cost was $51,612 and the actual variable overhead cost was $20,148. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The variable overhead efficiency variance for July is:

Definitions:

Assembly Worker

An individual employed in the manufacturing sector whose primary role involves assembling components or products.

Mixed Costs

Expenses that have both a fixed and a variable component, changing with the level of production or sales activity but also including a constant element.

Period Costs

Selling and administrative expenses incurred in marketing the product, delivering the product, or managing the company and not directly related to manufacturing the product.

Fixed Costs

Expenses that do not change in total regardless of changes in the volume of goods or services produced or sold.

Q8: Pearse Kennel uses tenant-days as its measure

Q19: Baldock Inc. is considering the acquisition of

Q43: Ebsen Corporation keeps careful track of the

Q68: Gabbert Corporation, which has only one product,

Q125: Muecke Inc. is working on its cash

Q153: Mutskic Corporation produces and sells Product BetaC.

Q171: Richards Corporation has the following budgeted sales

Q285: Taccone Corporation makes a product that has

Q325: Berends Corporation makes a product with the

Q348: Directly comparing a static planning budget to