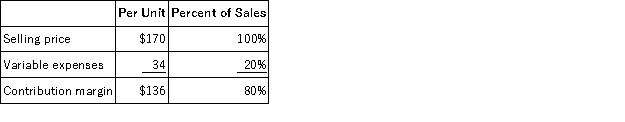

Data concerning Bunck Corporation's single product appear below:  Fixed expenses are $202,000 per month. The company is currently selling 2,000 units per month. Management is considering using a new component that would increase the unit variable cost by $18. Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 400 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $202,000 per month. The company is currently selling 2,000 units per month. Management is considering using a new component that would increase the unit variable cost by $18. Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 400 units. What should be the overall effect on the company's monthly net operating income of this change?

Definitions:

Q3: Axsom Inc. bases its manufacturing overhead budget

Q34: Sampaga, Inc., manufactures and sells two products:

Q35: Starg Corporation, a retailer, plans to sell

Q43: The budgeted selling and administrative expense is

Q44: Fulton Corporation uses the weighted-average method in

Q78: During its first year of operations, Carlos

Q89: The term gross margin is used in

Q108: Hewett, Inc., manufactures and sells two products:

Q129: The unit sales volume necessary to reach

Q176: Betenbaugh, Inc., manufactures and sells two products: