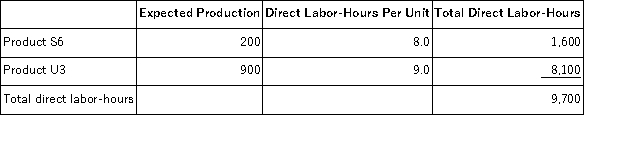

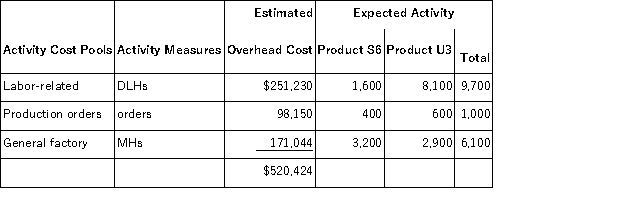

Sampaga, Inc., manufactures and sells two products: Product S6 and Product U3. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $20.90 per DLH. The direct materials cost per unit is $145.30 for Product S6 and $221.50 for Product U3. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The direct labor rate is $20.90 per DLH. The direct materials cost per unit is $145.30 for Product S6 and $221.50 for Product U3. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The overhead applied to each unit of Product U3 under activity-based costing is closest to:

The overhead applied to each unit of Product U3 under activity-based costing is closest to:

Definitions:

Q1: Bretthauer Corporation has provided data concerning the

Q35: A partial listing of costs incurred during

Q37: Accurso, Inc., manufactures and sells two products:

Q41: Pinkney Corporation has provided the following data

Q51: Conversion cost is the sum of direct

Q56: Gainer Corporation's standard wage rate is $11.70

Q88: Data concerning Ulwelling Corporation's single product appear

Q165: Masiclat, Inc., manufactures and sells two products:

Q172: Minist Corporation sells a single product for

Q183: Cost behavior is considered linear whenever a