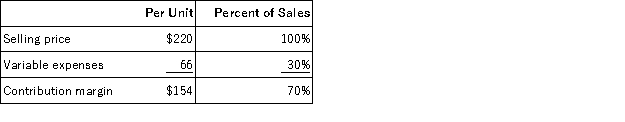

Data concerning Sumter Corporation's single product appear below:  Fixed expenses are $1,024,000 per month. The company is currently selling 8,000 units per month.

Fixed expenses are $1,024,000 per month. The company is currently selling 8,000 units per month.

Required:

Management is considering using a new component that would increase the unit variable cost by $6. Since the new component would improve the company's product, the marketing manager predicts that monthly sales would increase by 300 units. What should be the overall effect on the company's monthly net operating income of this change if fixed expenses are unaffected? Show your work!

Definitions:

Variable Overhead Rate Variance

The difference between the actual variable overhead incurred and the expected variable overhead based on standard cost.

Variable Manufacturing Overhead

Costs in the manufacturing process that change with the level of production output, such as utilities and materials used in production.

Last Month

Refers to the period of time from the first to the last day of the month immediately preceding the current month.

Variable Overhead Efficiency Variance

The difference between the actual hours taken to produce goods and the standard hours expected, multiplied by the variable overhead rate.

Q9: Peals Corporation has two divisions: Home Division

Q13: Cutterski Corporation manufactures a propeller. Shown below

Q66: Palomo Corporation sells a product for $170

Q132: The controller of Hartis Company estimates the

Q134: Jimerson Corporation produces a single product and

Q147: Rollison Corporation has two divisions: Retail Division

Q150: Salley Corporation produces and sells a single

Q154: Nantua Corporation has two divisions, Southern and

Q163: Roberts Corporation manufactures home cleaning products. One

Q221: Keefe Corporation has two divisions: Western Division