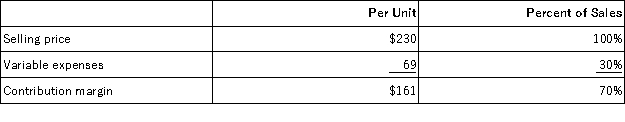

Grable Corporation produces and sells a single product. Data concerning that product appear below:  Fixed expenses are $628,000 per month. The company is currently selling 5,000 units per month.

Fixed expenses are $628,000 per month. The company is currently selling 5,000 units per month.

Required:

The marketing manager would like to cut the selling price by $18 and increase the advertising budget by $45,000 per month. The marketing manager predicts that these two changes would increase monthly sales by 800 units. What should be the overall effect on the company's monthly net operating income of this change? Show your work!

Definitions:

Impact Evaluation

Assessing the changes that can be attributed to a particular intervention, project, or program, focusing on outcomes that are the direct result of the intervention.

Formative Evaluation

An evaluative process used during the development of a new program or product to improve its design based on feedback.

Presentations

This term refers to the act of showing and explaining the content of a topic to an audience, often using visual aids.

Word "I"

The use of the first-person singular pronoun in communication, indicating self-reference by the speaker.

Q2: Common fixed expenses should be allocated to

Q6: Acklac Corporation uses the weighted-average method in

Q20: The contribution margin ratio of Baginski Corporation's

Q40: Accurso, Inc., manufactures and sells two products:

Q48: Spartan Systems reported total sales of $300,000,

Q81: Schweinert Corporation manufactures a single product. The

Q100: Barker Corporation uses the weighted-average method in

Q117: If direct labor-hours is used as the

Q145: Farron Corporation, which has only one product,

Q186: Grable Corporation produces and sells a single