The Commonwealth Company uses a job-order costing system and applies manufacturing overhead cost to jobs using a predetermined overhead rate based on the cost of materials used in production. At the beginning of the year, the following estimates were made as a basis for computing the predetermined overhead rate: manufacturing overhead cost, $186,000; direct materials cost, $155,000. The following transactions took place during the year (all purchases and services were acquired on account):

a. Raw materials purchased, $96,000.

b. Raw materials requisitioned for use in production (all direct materials), $88,000.

c. Utility bills incurred in the factory, $17,000.

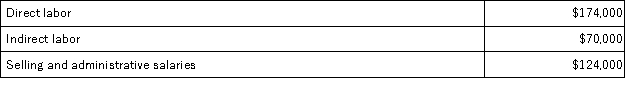

d. Costs for salaries and wages incurred as follows:  e. Maintenance costs incurred in the factory, $12,000.

e. Maintenance costs incurred in the factory, $12,000.

f. Advertising costs incurred, $98,000.

g. Depreciation recorded for the year, $75,000 (75 percent relates to factory assets and the remainder relates to selling, general, and administrative assets).

h. Rental cost incurred on buildings, $80,000 (80 percent of the space is occupied by the factory, and 20 percent is occupied by sales and administration).

i. Miscellaneous selling, general, and administrative costs incurred, $12,000.

j. Manufacturing overhead cost was applied to jobs.

k. Cost of goods manufactured for the year, $480,000.

l. Sales for the year (all on account) totaled $900,000. These goods cost $550,000 to manufacture.

Required:

Prepare journal entries to record the information above. Key your entries by the letters a through l.

Definitions:

Social-Cognitive Theorists

Scholars who study how cognitive, environmental, and behavioral factors influence individuals' learning and behavior.

Environmental Influences

External factors, such as social, physical, and cultural environments, that can impact an individual's behavior and development.

Habit Learning

Habit learning is a form of learning characterized by the automatic response to a situation gained through repeated exposure and behavioral reinforcement.

Gestalt Psychologists

Psychologists who emphasize that the whole of anything is greater than its parts and study how people perceive and experience objects as complete patterns.

Q3: Derf Corporation uses a standard cost system

Q15: The standards for product Q58W specify 8.4

Q18: The changes in Northrup Corporation's balance sheet

Q31: Cafferty Corporation has provided the following data

Q43: Given the cost formula Y = $18,000

Q45: When the actual amount of a raw

Q56: Arizaga Corporation manufactures canoes in two departments,

Q74: Hargenrader Inc. produces and sells two products.

Q96: Ence Sales, Inc., a merchandising company, reported

Q99: Littleton Manufacturing uses a standard cost system