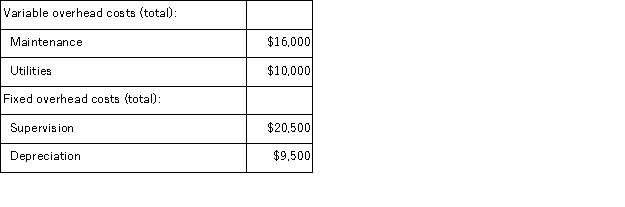

Pohl Corporation uses a standard cost system in which manufacturing overhead is applied on the basis of standard machine-hours. For June, the company's manufacturing overhead flexible budget showed the following total budgeted costs at a denominator activity level of 20,000 machine-hours:  During June, 17,000 machine-hours were used to complete 13,000 units of product, and the following actual total overhead costs were incurred:

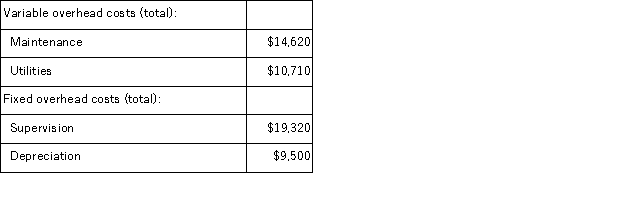

During June, 17,000 machine-hours were used to complete 13,000 units of product, and the following actual total overhead costs were incurred:  At standard, each unit of finished product requires 1.4 hours of machine time. The fixed manufacturing overhead budget variance (in total) for June was:

At standard, each unit of finished product requires 1.4 hours of machine time. The fixed manufacturing overhead budget variance (in total) for June was:

Definitions:

Normal Good

An item whose demand escalates as the income of consumers increases, and contracts when their income decreases.

Successively Less

Refers to a situation or process where there is a gradual decrease in quantity, quality, or intensity over time.

Satisfaction

A measure of how goods, services, or outcomes meet or exceed expectations, often related to customer or user experience.

Land Market

The input/factor market in which households supply land or other real property in exchange for rent.

Q14: Division A transfers a profitable subassembly to

Q21: Excel Division reported a residual income of

Q53: Which of the following transfer-pricing methods can

Q67: Riverside Company manufactures G and H in

Q68: Consider the following statements about the investment

Q72: Echo Corporation uses a job-order costing system

Q73: ROI is most appropriately used to evaluate

Q74: Which of the following terms describes a

Q99: James Company has an asset that cost

Q99: A number of antitrust laws have been