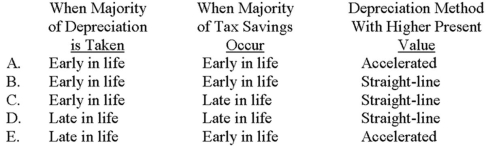

Preston Company is considering the use of accelerated depreciation rather than straight-line depreciation for a new asset acquisition. Which of the following choices correctly shows when the majority of depreciation would be taken (early or late in the asset's life) , when most of the tax savings occur (early or late in the asset's life) , and which depreciation method would have the higher present value?

Definitions:

Carbohydrate

Organic compounds, including sugars, starches, and celluloses, which are a major source of energy for the body.

Chemical

A substance that undergoes a chemical reaction, consisting of atoms or molecules.

Mechanical

Pertaining to the design, operation, and use of machines or tools.

Physical

Relating to the body as opposed to the mind or emotions, or being in a material state.

Q6: The Magellan Division of Global Corporation,

Q9: The _ is the amount remaining from

Q24: Delicious Treats (DT) anticipated that 84,000 process

Q39: A manufacturing company uses a standard costing

Q41: Consider the following statements about the step-down

Q48: Consider the following statements about the total-cost

Q48: Under the direct method of determining the

Q53: Zena Company manufactures two products (A

Q62: The Dopler Manufacturing Company has two

Q90: A manufacturing company uses a standard costing