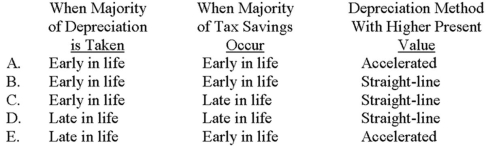

Preston Company is considering the use of accelerated depreciation rather than straight-line depreciation for a new asset acquisition. Which of the following choices correctly shows when the majority of depreciation would be taken (early or late in the asset's life) , when most of the tax savings occur (early or late in the asset's life) , and which depreciation method would have the higher present value?

Definitions:

Excess Capacity

The situation in which a firm's production capabilities exceed the demand for its products or services.

Service Firms

Companies that primarily offer intangible products, such as expertise, assistance, or information, rather than physical goods.

Pure Chase Strategy

A demand matching or production strategy where output is adjusted to match demand precisely, reducing inventory levels to a minimum.

Subcontracting

The practice of assigning part of the obligations and tasks under a contract to another party, often to specialize or expedite processes.

Q4: Sahara Corporation has no excess capacity. If

Q7: James just received an $8,000 inheritance check

Q10: How much would you have to invest

Q28: The true economic yield produced by an

Q36: Sand Fly Corporation operates two stores:

Q52: Nitrol Corporation manufactures brass vases using a

Q59: The Shoe Department at the El

Q82: CompuTronics, a manufacturer of computer peripherals,

Q113: Management of Childers Corporation is considering whether

Q179: In April direct labor was 70% of