Eagle Airways Company is planning a project that is expected to last for six years and generate annual net cash inflows of $75,000. The project will require the purchase of a $280,000 machine, which is expected to have a salvage value of $10,000 at the end of the six-year period. The machine will require a $50,000 overhaul at the end of the fourth year. The company presently has a 12% minimum desired rate of return.

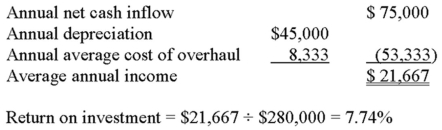

Based on this information, an accountant prepared the following analysis:

The accountant recommends that the project be rejected because it does not meet the company's minimum desired rate of return. Ignore income taxes.

Required:

A. What criticism(s) would you make of the accountant's evaluation?

B. Use the net-present-value method and determine whether the project should be accepted.

C. Based on your answer in requirement "B," is the internal rate of return greater or less than 12%? Explain.

Definitions:

Homo Neanderthalensis

An extinct species or subspecies of archaic humans who lived in Eurasia until about 40,000 years ago.

Buried Dead

The practice of interring deceased organisms in the ground, often as part of a ritual or cultural ceremony related to death.

Homo Erectus

An extinct species of hominid that lived from the end of the Pliocene epoch to the later Pleistocene, known for upright walking.

Homo Habilis

An early species of human characterized by its use of stone tools, dating back to around 2.8 million years ago.

Q17: Digby Corporation's balance sheet and income statement

Q18: Which of the following would not be

Q18: One of the most important conditions for

Q27: An allocation base for a cost pool

Q30: When a company is analyzing a capital

Q32: An unfavorable labor efficiency variance is created

Q39: Hayward Corporation had net sales of $610,000

Q42: Jasper Corporation is organized in three

Q54: Gamma Division of Vaughn Corporation produces electric

Q96: You have just been hired as the