Baker, Inc. produces a number of components that are used in home theater systems. Fred Briggs, head of the company's market research department, has identified the need for a new component that will most likely sell for $75. Projected volume levels are anticipated to reach 28,000 units in the first year, as several firmly entrenched competitors will be introducing a similar product in the not-too-distant future.

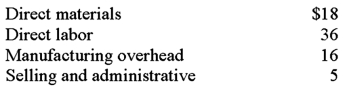

Conversations with Baker's engineers and reviews of cost accounting data related to similar products that the company manufactures resulted in the following cost estimates for the new component:

Baker currently uses cost-plus pricing and adds a 20% markup on total production cost to arrive at what is normally a competitive selling price.

Required:

A. What is the anticipated selling price of the new component if Baker uses its current pricing policy? What difficulties, if any, might the company face in the marketplace?

B. Assume that Baker decides to switch to target costing. What price would the company charge for the new component?

C. With the switch to target costing, what would Baker have to do to the component's manufacturing cost to achieve the normal profit margin on sales? Be specific and show calculations.

Definitions:

Multicollinearity

A situation in statistical models where several predictor variables are highly correlated, which can undermine the statistical significance of an independent variable.

Predictor Variables

Independent variables in statistical models that are used to predict the value of a dependent variable.

Linear Regression

A statistical method for modeling the relationship between a dependent variable and one or more independent variables by fitting a linear equation to observed data.

Correlation Matrix

A table showing correlation coefficients between variables, indicating the strength and direction of relationships.

Q2: Fowler Industries produces two bearings: C15 and

Q30: Which of the following variances are most

Q36: Benson Company, which uses a standard cost

Q49: Eagle Airways Company is planning a project

Q51: When the actual direct labor-hours exceeds the

Q52: Nitrol Corporation manufactures brass vases using a

Q57: Masek Corporation has a standard cost system

Q79: Suppose that one hog yields 250 pounds

Q82: Economic value added (EVA) analysis indicates:<br>A) the

Q83: The budgeted income statement, budgeted balance sheet,