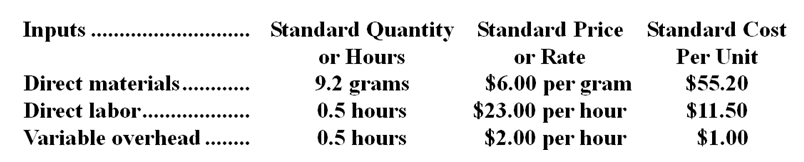

Sande Corporation makes a product with the following standard costs:  In November the company's budgeted production was 2,900 units but the actual production was 3,000 units. The company used 27,670 grams of the direct material and 1,390 direct labor-hours to produce this output. During the month, the company purchased 31,700 grams of the direct material at a cost of $196,540. The actual direct labor cost was $29,607 and the actual variable overhead cost was $2,502.

In November the company's budgeted production was 2,900 units but the actual production was 3,000 units. The company used 27,670 grams of the direct material and 1,390 direct labor-hours to produce this output. During the month, the company purchased 31,700 grams of the direct material at a cost of $196,540. The actual direct labor cost was $29,607 and the actual variable overhead cost was $2,502.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The labor efficiency variance for November is:

Definitions:

Legal Tender

U.S. currency that constitutes a valid and legal offer of payment of debt.

Money

Any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts in a particular country or socio-economic context.

Issued

Issued generally refers to the official distribution or release of items such as documents, currency, or securities by an authoritative entity.

Declared

Stated or made known officially or publicly.

Q19: Ideal standards should be used for forecasting

Q20: Norgaard Corporation has two operating divisions: a

Q29: The division's margin is closest to:<br>A)26.2%<br>B)23.5%<br>C)2.7%<br>D)11.5%

Q33: Expected cash collections in December are:<br>A)$360,000<br>B)$149,600<br>C)$198,000<br>D)$347,600

Q42: The materials price variance for December is:<br>A)$710

Q54: The total number of units produced in

Q55: If the actual level of activity is

Q76: Franklin's variable overhead rate variance for the

Q113: The following standards for variable manufacturing overhead

Q137: The variable overhead rate variance is:<br>A)$240 U<br>B)$220